The U.S. government hasn’t been left behind in the inexorable march of technology. Electronic Benefits Transfer (EBT) is a prime example of how the government has embraced technological advancement. According to the U.S. Department of Agriculture’s Food and Nutrition Service (USDA FNS), EBT is an electronic system used to authorize the transfer of funds from a customer’s federal benefits account to a retailer in exchange for goods. EBT has been a part of the American benefits system since 2004, initially being offered for use with the Supplemental Nutrition Assistance Program (SNAP) in all fifty states. The system is slowly entering usage in other benefits programs, such as the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

The move towards accepting non-cash payments was facilitated when the government started issuing EBT cards. These cards look just like debit cards and function similarly. However, they can’t be used with traditional point-of-sale technology. For a merchant to accept EBT payments, he or she needs to invest in a specialized EBT payment processing system.

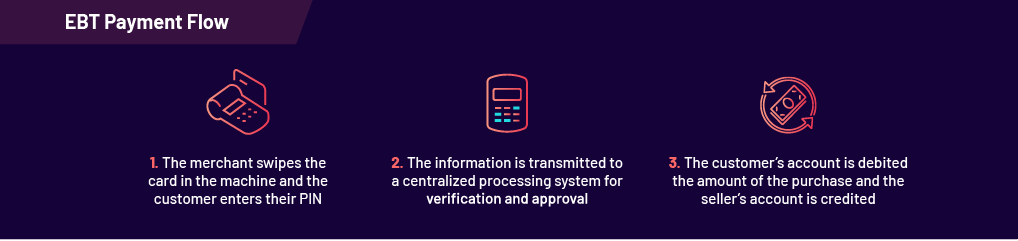

How EBT Payments Work

EBT payments are relatively simple since they function on the same principles as debit card payment systems. First, the merchant swipes the card in the machine and the customer enters their PIN. The information is transmitted to a centralized processing system that verifies the PIN and the amount in the user’s account, and then sends back an approval. Once the account verification and approval is completed, the customer’s account is debited the amount of the purchase and the seller’s account is credited. At the end of the day, statements are “settled,” in which funds move out of the buyer’s account and into escrow. Merchants usually get access to these funds within two business days.

Types of EBT Payments

EBT payments aren’t one single, monolithic payment system. There are several different government-funded programs that link to EBT cards. The two largest programs are:

1. WIC

According to the official U.S. Government Benefits Program, WIC (Women, Infants, and Children) is dedicated to providing financial support for women and children who may be at nutritional risk. In 2010, the Healthy, Hunger-Free Kids Act mandated that all WIC State Agencies adopt an electronic benefit transfer (EBT) system. State deadlines have rolled out in stages over the past 10 years, and all states are expected to have implemented EBT processing by the end of 2020.

2. SNAP

The Supplemental Nutrition Assistance Program (SNAP), as the Center on Budget and Policy Priorities (CBPP) informs us, is also known as the Food Stamp system, and has been instrumental in providing funds to ensure that over 40 million low-income American families can have food on the table.

Besides for SNAP and WIC, there is also the TANF program, or Temporary Assistance for Needy Families. This program provides financial assistance to low-income families with children.

In response to the widespread impact of the global COVID-19 pandemic, SNAP and WIC have become even more critical to the country’s well-being. Merchants who form the backbone of the economy need to address the increased number of buyers possibly invested in using the EBT system. In this paper, we’ll explore the implementation of an EBT system, and why it’s such a significant concern for merchants. Before we delve into that, however, we’ll look at each of these benefit programs in detail to get a feel for the clients who may use them.

What is SNAP?

As noted before, the SNAP program came about to alleviate the financial plight of low-income families throughout America. In 1933, President Franklin D. Roosevelt signed into being the Agricultural Adjustment Act (AAA) to cater to the oversupply of farm produce during the Great Depression. The resulting food was sold to relief agencies at a discount to provide aid to low-income families.

This informal program was officially recognized and supported through Henry Wallace’s Food Stamp Program in 1939. Food stamps became a way to ensure that aid granted for food was used for that purpose. The food stamps could not be exchanged for money or used to buy anything that wasn’t explicitly designated on the program’s list. The program was reintroduced in 1961 by President John F. Kennedy. In 1964, President Lyndon B. Johnson changed the plan around, allowing for bonus stamp allocation for families that fell under a certain “minimum” level. The bonus stamps were a measure intended to help low-income families buy nutritionally adequate supplies.

President Ronald Reagan slashed the amount of money allocated to the program in 1980, but an educational element, now known as SNAP-Ed, was introduced. This introduction laid the foundation for teaching nutritional education in all 50 states. In 2000, food stamp eligibility started to broaden its definitions to include qualified immigrants and their children. Beginning in 2000 and culminating in 2004, the food stamps program, now known as SNAP, began disbursing its benefits via EBT cards. The 2014 Farm Bill, signed into law by President Barack Obama, attempted to focus more on the purchase of fruits and vegetables, even though it restricted the purchase of alcoholic beverages or tobacco products.

Bringing Benefit Payments Into the Twenty-First Century

As technology has advanced, many low-income families have turned to online shopping. To cope with this trend, the FNS has introduced a pilot program for online purchases of SNAP goods using EBT. At the time of this writing, 44 states have joined the SNAP Online Purchasing Pilot and only a handful of large retailers are supported. However, with the pilot program’s establishment, the FNS has also opened the door to other SNAP-certified businesses to register as online retailers.

The Growth of Online Grocery Sales

Supermarket News informs us that 52% of consumers in a recent survey stated that they purchased groceries online during the past year. Customers were beginning to prefer the convenience of online shopping prior to the COVID-19 pandemic, but the effects of the pandemic have accelerated this trend even further. The Center on Budget and Policy Priorities (CBPP) notes that many states respond to the increased pressure on supply lines by tapping into temporary flexibility built into SNAP. The Department of Human Services (DHS) has also announced that many families who use SNAP will see an increase in benefits due to the pandemic.

For retailers, this puts an added incentive towards accepting EBT payments within their stores and online. Getting started with SNAP EBT online isn’t a complicated process, but it does take time.

Getting Started With SNAP Online

There are a few vital steps that any business intending to accept EBT payments on their online store needs to perform, namely:

1. Qualify and Register as a SNAP Retailer

There are a series of guidelines that the FNS outlines on their website for companies that want to establish themselves as SNAP retailers; for example, the types and quantity of food products in stock. Once you meet these guidelines, your business becomes eligible to apply as a registered SNAP recipient company. If you’re eligible, you can move on to the next step.

2. Submit a Letter of Intent to the FNS

The FNS requires all businesses registered as SNAP certified sellers to submit a letter of intent if they aim to start accepting online payments for SNAP-approved goods. This letter of intent helps the administration determine the interest and capacity for accepting SNAP payments online, and it jumpstarts the preprocessing necessary to add a new retailer to the approved retailer list.

3. Ensure Online Purchasing Eligibility

A further set of guidelines from the FNS guides companies that are already SNAP retailers but want to accept EBT cards for eligible online purchases. The requirements state, among other things, that e-commerce sites MUST be updated to work alongside elements of online finance like online PIN entry.

Online PIN Entry vs. Offline PIN Entry

Once clients start using their EBT cards to pay for goods, the process is similar to accepting a debit or credit card for payment. However, things are very different online. Whereas users can enter their PIN on a keypad in-store, they do not have this option online. As such, merchants who want to implement this service need an online PIN entry system that is secure yet easy to execute on the business’s existing e-commerce platform. Luckily, Sola has developed a dedicated online PIN entry system that integrates seamlessly with leading e-commerce platforms. Users can safely enter their EBT PIN at checkout, and the merchant’s business will receive payments similar to if someone were to make a credit or debit card purchase online.

What is WIC?

The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) offers relief to pregnant, breastfeeding, and non- breastfeeding postpartum women. It also provides financial aid for children up to the age of five who may be at nutritional risk. In 1972, the administration proposed establishing an aid program for pregnant mothers and at-risk children, which they finally implemented in Kentucky in 1974. At The Special Supplemental the end of 1974, the WIC program rolled out across 45 states in the US. Nutrition Program for Women, Infants, and Children (WIC) offers relief to pregnant, breastfeeding, and non-breastfeeding postpartum women.

In 1978, new legislation introduced the requirement that states follow up on aid provided and coordinate referrals to programs for drug abuse, child abuse, immunization, and family planning. This legislation also ensured that recipients would benefit from the included nutritional education that came with the plan. Additionally, the levels of nutrients contained in the products covered under WIC needed to conform to specific standards.

Between 1992 and 2004, the program focused on promoting the healthy aspects of breastfeeding and helped to provide more nutritional support to new mothers. Further tweaks were made in 2009, allowing WIC to tap into new research developed by the USDA to introduce more nutritious foods for breastfeeding women.

Introducing eWIC

Initially, the WIC program used a paper voucher system for payments. Using vouchers ensured that the money spent to buy these items couldn’t be used for non-essential purchases. These vouchers could be redeemed at checkout for a similar monetary value as cash. Merchants would then need to supply these vouchers to WIC to receive their payments. In the 2000s, WIC moved to start distributing payments through the EBT system, making life a lot easier for both merchants and recipients. The electronic payments system is known as eWIC, or electronic WIC.

WIC EBT or eWIC is a simplified system for merchants who deal with WIC goods to accept payments. eWIC incorporates a management information system (MIS) to ensure that all payments happen promptly. This information system also introduces a simple method of tracing payments to help the program plan for the future. As the U.S. government benefits systems starts moving towards an electronic payment reality, deadlines have rolled out across the country to require WIC merchants to accept eWIC payments. Eventually, the move intends to eliminate the voucher system fully, replacing it with the EBT system.

Getting Started With eWIC

To start processing eWIC payments, retailers must follow these steps:

1. Contact Their State WIC Agency

In order to apply to be a WIC vendor, retailers must first contact their state agency. The agency will review which foods are available in the store and at what quantities, the prices of food, and the business’s overall standing.

2. Obtain the Right eWIC Processing Equipment

WIC EBT cards don’t work on existing store processing systems unless changes have been made. Merchants have two options for processing eWIC payments:

Standalone eWIC Terminals

These terminals only accept EBT cards. The downside of these terminals is that if someone uses an eWIC EBT card, they can’t split the purchase with other payment methods. The money that these terminals process is credited directly to merchants’ EBT processor accounts.

Standalone terminals can be obtained from government-approved processors that provide eligible merchants with the hardware, such as Conduent.

An Integrated POS System

While conventional point-of-sale systems can’t accept eWIC cards, custom coding can easily refit a POS system to handle these cards—which means that the POS system can be integrated with a standard payment terminal to accept eWIC. Merchants who use this methodology can accept multiple payment types using a single terminal. Additionally, since only one terminal is needed, merchants can have a single reconciliation cycle. There’s no need to reconcile more than one terminal to get paid.

With the help of simple coding based around an easy-to-use SDK like Sola’s, it takes less time to get standard POS terminals working with eWIC cards.

Which One is Better?

Standalone eWIC terminals come with a lot of caveats. While merchants don’t have to make as many changes to their in-store setup, they are clunky for customers. The inability to split a transaction could cause more harm than good for low-income families. Moreover, these terminals need to be settled manually, meaning that merchants will spend more time to conclude their transactions at the end of the day.

Integrated POS terminals don’t have the issue of being limited to only accepting eWIC cards. The same terminal a merchant uses for EMV, magstripe, or contactless credit and debit cards can be refitted for use with eWIC cards—without interrupting business for any significant length of time. In the case of merchants who have inventory and bookkeeping software, the single terminal makes life a lot easier for updating individual records in each system. If those systems are independent, then the single POS terminal ensures that all transactions are adequately synced. There’s no need for manual entry of POS data into either software. By removing this hurdle, integrated POS solutions also reduce the incidence of error propagation in merchant records.

Merchants who are looking at either method should understand that integrated POS terminals are far easier to manage. There is no drawback to using software to turn your POS into one that accepts EBT payment cards. However, having a standalone EBT terminal doesn’t grant you the freedom to use it for debit and credit card processing. If you can have all your processing on a single terminal, why would you want two different devices?

The Benefits of Accepting EBT Cards

The EBT initiative is a brilliant step by the U.S. government to offer a more secure payment system for those on the SNAP and WIC programs. By introducing the EBT payment methodology, the government took a step towards improving the choices of lower-income communities. EBT empowers those on government benefits to shop proudly, and it also allows merchants to be more confident in accepting government payments.

The previous iterations of payment methods (food stamps and paper vouchers, as mentioned above) created a barrier for everyday merchants to accept payment. With the advent of the EBT system, even small and medium retailers can benefit from electronic payments. Now, new integration systems have made it even simpler to aid merchants in refitting their current POS systems to work with EBT cards.

The reduction of barriers for processing EBT transactions benefits consumers by giving them a more extensive choice of retailers to shop at. It also increases their self-sufficiency and gives them the power of consumer choice. For merchants, EBT integrations allow them to be confident in accepting payments and enables them to offer several solutions to customers. Flexible payment options (such as splitting the bill between the EBT card and another card) and single-terminal reconciliation help merchants keep their records adequately updated.

EBT Solutions From Sola

SNAP and WIC payments moving online have created a need for digital processing services to handle these cards. Some merchants who have been using the standalone eWIC terminals have expressed their dissatisfaction with the service. Additionally, merchants who want to start accepting SNAP EBT online have been searching for a simple solution to integrate into their e-commerce platforms. Sola answered this call by creating a single software development kit (SDK) that developers can rely on to help build solutions to these problems.

In-Store SNAP Processing

To leverage your in-store terminal to process EBT payments, Sola has provided an SDK that integrates with a wide range of grocery POS systems. Customers using EBT cards for SNAP purchases can swipe their cards in the same terminal that is used for debit and credit card processing.

Sola’s API provides gateway emulators and simple code to ensure that processing happens in the blink of an eye. With a little smart programming, a standard POS terminal can process EBT payments like any other type of card.

SNAP Online EBT Processing

As SNAP retailers start moving their businesses online, they need a reliable method of accepting EBT payments with PIN entry. Naturally, most e-commerce systems don’t come with built-in functionality for online PIN entry. Sola provides an API that integrates seamlessly with many grocery e-commerce systems to enable online PIN entry— among other benefits like robust security, competitive rates, and much more.

Sola’s tools don’t limit payments to EBT cards only; they cover a wide range of alternative payment options for clients. Online grocery retailers can also depend upon advanced security features like tokenization and fraud prevention tools. Sola’s solutions minimize merchants’ processing costs while ensuring that customer payment data remains secure throughout the entire process.

In-Store eWIC Processing

Sola is an eWIC certified payment solution that merchants can rely on. The gateway we offer to clients demonstrates full integration with existing POS systems with a minimum of fuss. Once Sola’s processing is refitted onto a POS terminal, it can start accepting eWIC cards just like other credit or debit cards.

All of this can be done from a single terminal, reducing the amount of hardware that the merchant needs to have present. The transactions that a merchant completes through their POS terminal with eWIC cards are registered alongside all other purchases and can be monitored in the merchant’s POS system or in the Sola Merchant Portal virtual terminal solution. This single source of payments means that all records and bookkeeping are updated without the need for manual entry of eWIC transaction data.

As a certified eWIC payment solution, Sola has a responsibility to its merchants who decide to use the service. Part of that responsibility is the dedication to keeping our firmware up to date. If changes occur within the eWIC system, we roll out updates to users as soon as possible to keep processing smooth.

We also update our support in line with eWIC’s Approved Product List (APL). This list changes over time as items are added and removed from it with each legislation cycle. Our dedication to updating the list ensures that your transactions always use the most current APL version, without any effort on your part.

Summing It Up: Electronic Payments Are the Future

We’ve already seen that governmental agencies understand the necessity of providing a way to pay for goods electronically. For merchants, giving customers this option makes a business more marketable. As the COVID-19 crisis deepens, even more families will need methods of paying for their groceries online.

A single, unified processor can help to simplify compatibility issues while making life easy for merchants, software developers, and independent software vendors (ISVs). Sola focuses on being that provider. We give developers, solution providers, and merchants alike the chance to use new technology.

Embrace new technology and simplified payments as offered by Sola. Contact us today to find out more about our payment processing solutions and how they can work for your business today.