In today’s digital age, where software vendors play a critical role in shaping seamless and secure transaction experiences, payment tokenization is a powerful tool. It offers businesses a powerful solution to safeguard financial data while ensuring frictionless payment processing. As businesses navigate the crowded waters of online commerce and strive to meet evolving consumer demands, a deep understanding and effective implementation of payment tokenization can strengthen their competitive edge in the market.

What is payment tokenization?

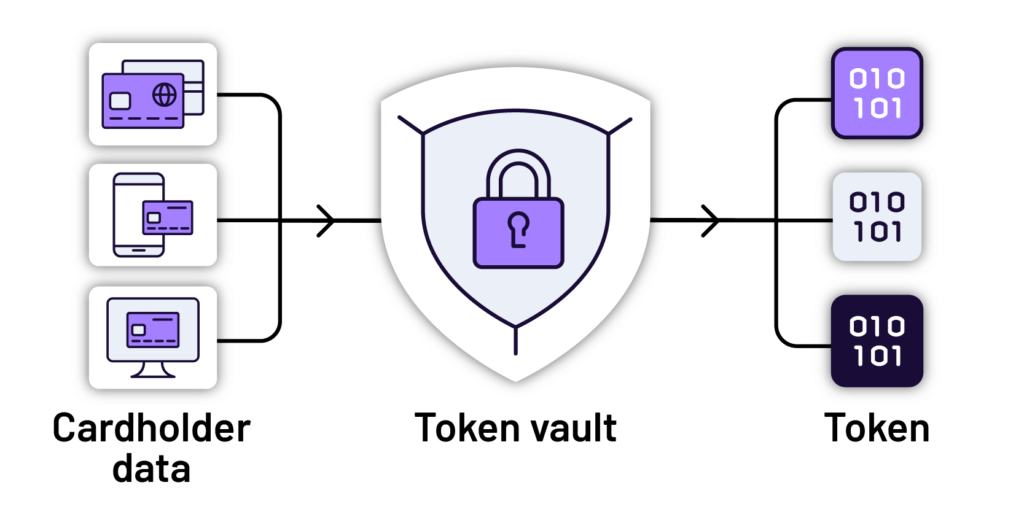

Payment tokenization is a process that substitutes sensitive data, such as credit card numbers, with unique identifiers called tokens. These tokens consist of a random set of characters that reveal no meaningful information and are virtually impossible to decipher if intercepted. Thus the payment data, securely stored in a token vault, remains inaccessible to hackers, significantly reducing the risk of data breaches and fraud. This makes payment tokenization a vital security measure for software vendors to integrate into their solutions.

Real-world applications

E-commerce platforms

For online retailers, ensuring a smooth checkout process is table stakes for customer retention. Payment tokenization simplifies the flow by securely storing customers’ payment information: With the token standing in for the actual card data, the transaction is streamlined and the risk of data theft is reduced.

Subscription-based services

Businesses offering subscription-based services often require recurring payments. Payment tokenization can facilitate these transactions by enabling businesses to securely store customers’ payment information for future use, eliminating the need for users to repeatedly enter their card details.

Mobile payments

With the rise of mobile wallets and contactless payments, payment tokenization helps secure transactions conducted through smartphones and other mobile devices. By replacing sensitive card data with tokens, mobile payment platforms ensure that users’ financial information remains protected — even in the event of a lost or stolen device.

The benefits of payment tokenization

Enhanced security

By replacing sensitive data with tokens, payment tokenization reduces the risk of fraud, safeguarding both businesses and their customers.

Customer retention optimization

With streamlined checkout processes and enhanced security measures, businesses can provide users with a hassle-free payment experience. Tokenization eliminates the need for customers to repeatedly provide payment details, streamlining recurring payments and providing a more seamless customer experience.

Compliance

Payment tokenization helps businesses comply with data protection regulations, such as the Payment Card Industry Data Security Standards (PCI DSS), by reducing the scope of sensitive data that needs to be stored and protected.

Scalability

As software vendors scale, they must routinely update their infrastructure for new users and new payment methods. Tokenization facilitates smooth integration of diverse payment technologies, ensuring security and consistency across all markets.

How Sola can help

In a world where cyber threats are prevalent, payment tokenization offers businesses a robust solution to protect sensitive financial information while facilitating efficient transactions. The good news? Sola offers robust, cost-effective solutions that implement this tool automatically. Contact us today to get started.