PayFac-as-a-Service (PFaaS) models like our Sola Go solution deliver tremendous value to businesses that want to integrate payments into their offerings, including instant merchant onboarding, more control over the customer experience, and increased earning potential. However, it can be challenging for clients to fully understand the ins and outs of the PayFac model. Keep reading to learn more about how PayFacs work and what their core benefits are!

What is a PayFac?

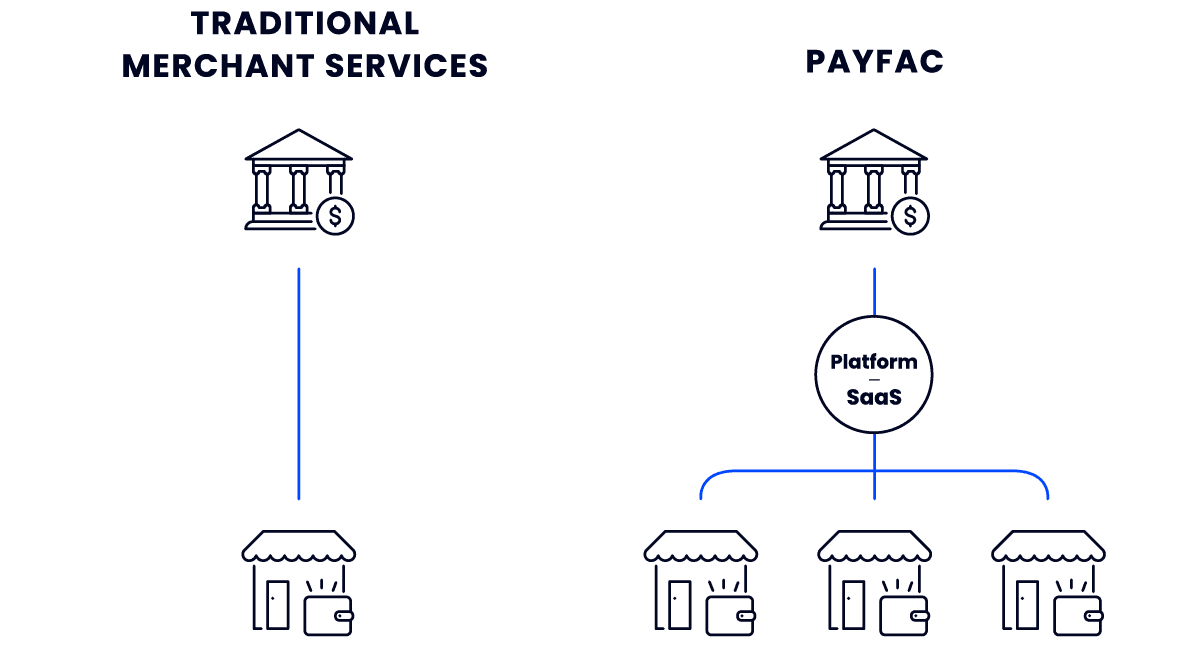

A payment facilitator is a merchant services provider that enables businesses to process credit card payments. An increasing number of ISVs and SaaS providers are becoming payment facilitators so that they can provide their clients with streamlined account onboarding and integrated payment processing features—all while growing their own revenue.

How Does it Differ from the ISO Merchant Services Model?

With a typical ISO model, your clients work directly with the payment processor to onboard and register to process payments. Together, ISOs and ISVs share in the revenue generated from processing fees. In contrast, a PayFac builds and maintains its payment infrastructure to interact directly with clients and control the user experience. PayFacs enjoy the opportunity to earn more revenue — however, they carry the increased costs and risks associated with payment processing.

The Growth of PayFac-as-a-Service

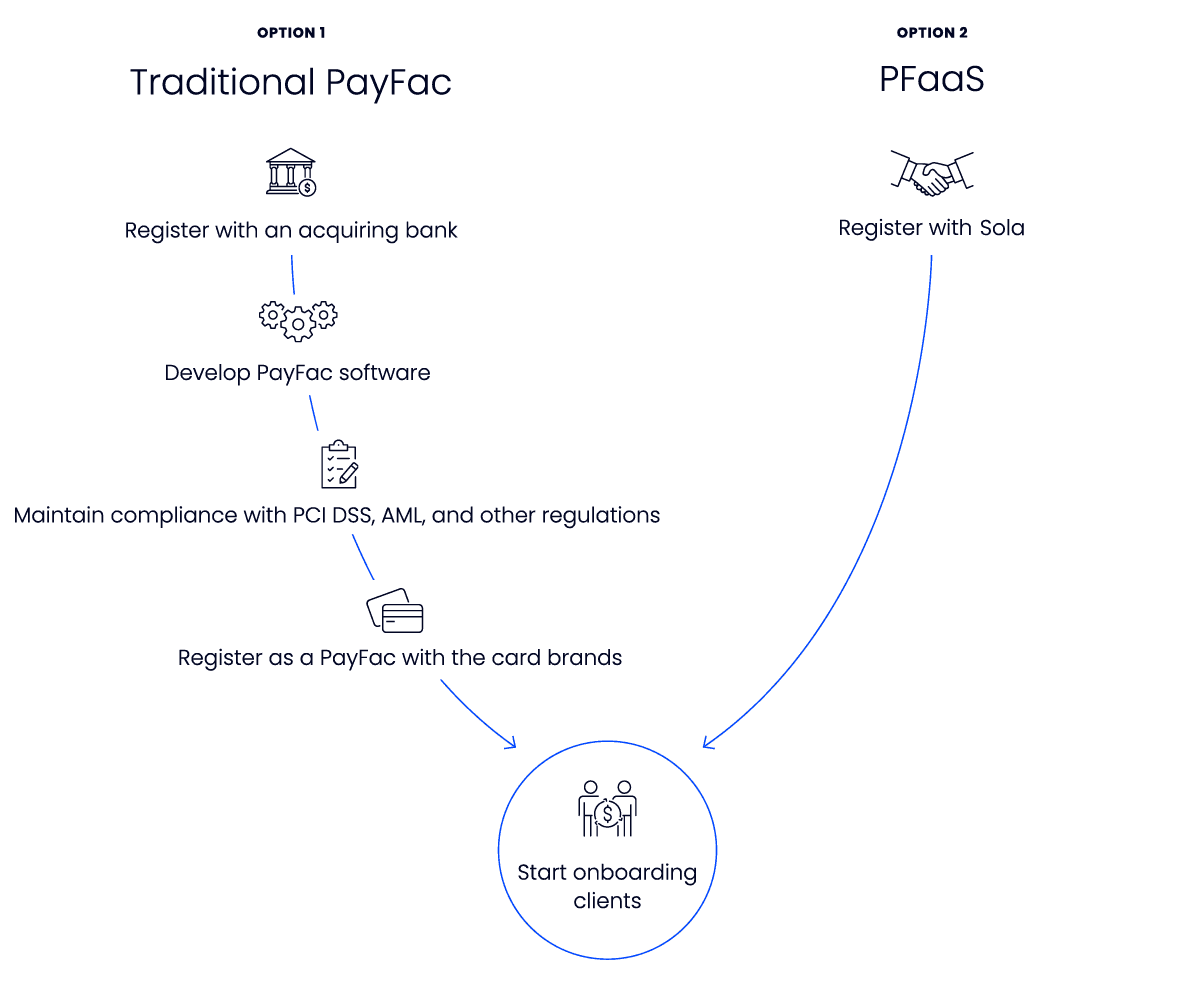

The traditional path to becoming a PayFac is complex, costly, and risky—requiring significant overhead costs and years dedicated to building a PayFac infrastructure from the ground up. ISVs choosing this path need to develop software, become compliant with numerous regulations, and carefully oversee risk management.

To simplify the PayFac journey for ISVs, payment solution providers like Sola offer the PayFac-as-a-Service (PFaaS) model. PFaaS products like Sola Go are out- of-box solutions that equip businesses with everything they need to become PayFacs: software, compliance, risk monitoring, and so much more.

Benefits of the PayFac Model

- High Earning Potential

- Rapid Onboarding

- Simple Flat-Rate-Structure

Benefits of the Sola Go PFaaS Solution

All the benefits of the traditional PayFac model, plus:

- Rapid Time-to-Market (months rather than years!)

- Reduced Risk Burden

- Easy Integrations That Minimize Scope of Development

- Advanced Payment Technology for In-Store, Online, & Mobile

- Greater Control Over Sub-Merchant Boarding & Payouts

- Industry-Leading Customer Service

Expected revenue generated by PayFacs in 2025

Potential Increase in Revenue for SaaS Providers Who Become a PayFac

Potential Increase in Valuation for SaaS Providers Who Become a PayFac

The year the first PayFac program was launched by Mastercard

Interested in becoming a PayFac?

Partner with Sola for the most hassle-free experience and generous revenue-sharing opportunities.